There was a time when Inheritance Tax (IHT) was a discussion reserved for the rich and the famous.

Those days are long gone.

A report published last year predicted that the number of families in the UK facing an IHT bill would hit a 35-year peak in 2017.

The surge in house prices and inflation of other assets has contributed heavily to this situation. Granted, the government provided some relief with the introduction of the ‘main residence nil-rate band’ – which we’ll discuss further below – but the reality is, IHT will continue to impact more and more people.

After all, the exchequer itself has predicted that IHT receipts will rise from £4.4bn (2015-16) to £5.6bn by 2020-21; and that includes the new relief!

So, What is Inheritance Tax?

Good question.

Inheritance Tax is a tax on the estate (the property, money, and possessions) of someone who has passed away.

As a result, it is not-so-quite fondly referred to as the ‘death’ tax.

Many perceive it as unfair, given that it feels like you could be paying more tax on assets you already own, and most likely paid tax on the income used to purchase them in the first place.

How does it work?

You’ll normally have no Inheritance Tax to pay if either:

- the value of your estate is below the £325,000 threshold, or

- you leave everything to your spouse or civil partner, a charity, or a community amateur sports club.

And there are certain reliefs and allowances available to you. For example:

- If you give away your home to your children (including adopted, foster, or stepchildren) or grandchildren, your threshold will increase to £425,000.

- If you’re married or in a civil partnership and your estate is worth less than your threshold, any unused threshold can be added to your partner’s threshold when you die. This means their threshold can be as much as £850,000.

How is it calculated?

The standard IHT Tax rate is 40%. And it’s only charged on what’s above the threshold.

Example: Your estate is worth £500,000 and your tax-free threshold is £325,000.

The Inheritance Tax charged will be 40% of £175,000 (£500,000 minus £325,000).

In this case, you could be facing a bill of £70,000.

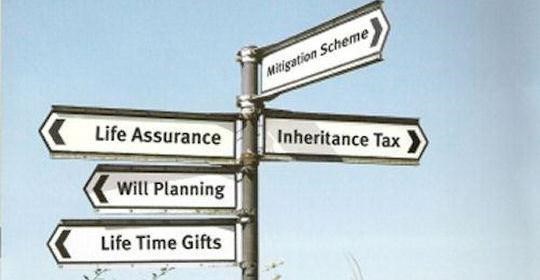

What are the solutions?

There are a few options open to you to work within the rules and reduce your IHT liabilities. These include:

- Making a gift to your partner.

- Putting things into a trust.

- Leaving something to charity (reduces the IHT rate to 36% if you leave at least 10% to a charity).

- Taking out life insurance.

- Making a will.

Some very important changes

The changes to Inheritance Tax rules – phased in from April of this year – mean that you’ll be able to leave a lot more to your loved ones IHT free.

The value of the ‘main residence nil-rate band’ for an estate will either be the lower of the net value of the interest in the residential property (after deducting any liabilities, such as a mortgage), or the maximum amount of the band.

The band currently stands at £100k and will be increased to £175k gradually over the next 4 years.

Our Advice? Speak with Ten Forward

With a tremendous amount of reliefs and allowances available, each one surrounded by a myriad of rules and principles written into the various editions of the Finance Act, it can be positively puzzling to know where to start.

Unravelling these requirements takes a professional with experience and access to the legislation, interpretation, and case history.

What’s more, taking advantage of the majority of these opportunities requires a great deal of forward planning – sometimes years in advance!

We here at Ten Forward have the experience, the processes, and – most importantly – the desire to help our clients plan for the future, both for them and their families.

No-one likes talking about their mortality, but we try to make that conversation a little easier by offering the peace of mind that your loved ones won’t need to carve up your assets just to pay an unexpected tax bill.

If you’re ready to start planning by undertaking a brief review of your current financial position, contact one of our friendly advisors today.